Table of Contents

What Is A Donation Receipt?

A donation receipt is a form of communication that a donor can use to formally acknowledge a gift. They serve as a form of acknowledgment that lets the donor know that their gift has been received. A donation receipt is a vital step that donors can use to claim charitable deductions on their tax returns.

Most non-profits, charities, or bigger organizations involve themselves in charitable activities, which is why they require a receipt as proof of expenditure, which helps them during taxation. Individuals also need the documentation when it comes to philanthropic activities for tax declarations.

Are Donation Receipts Necessary?

A donation receipt is an important document that details a person’s gift to an organization. It serves as a record of the transaction, keeps track of donations and can be used for tax purposes. If your organization has a recurring donation program, it is better to include details about the organization’s recent activities to make the recipient feel connected to the cause.

It’s also important for organizations to provide a receipt of donations to their donors. Most of the time, people expect to receive a receipt after making a donation. Basically, a donation receipt is very beneficial to both the organization and the donors. They can help reduce your tax liability.

While receipting is a vital part of an organization’s operations, it also serves as an opportunity to show gratitude to donors. Having a good receipting system also helps keep track of all the donations that were made.

Types Of Charitable Donations Receipts

- Charity Donation Receipt: A charitable donation receipt is a letter or email that a donor receives after a gift has been received.

- Cash Donation Receipt: Cash donation receipts are provided in case donations are made in the form of cash. If the identity of the donor is available, then the donation can be called anonymous. However, if the amount is received in cash, then the donation can be considered anonymous.

- In-Kind Donation Receipt: In-kind donations are tax-deductible as long as the goods are of equal or greater value. They can also be used for volunteer work and are not tax-deductible. The recipient should also include the details of the gift in the donation receipt.

- Auction Donation Receipt: In auctions, there are 2 types of donation receipts issued, i.e., receipts for items donated and receipts for items bought. In cases of item donations, a receipt can be issued for the fair market value of the goods or services provided. For items bought at an auction, the fair market value must be established before the event.

What Size is a Donation Receipt Format?

Regardless of the type of charity that you work with, your receipt needs to contain basic information to ensure that it is useful to donors. This is especially important when it comes to fundraising. Having a standard non profit donation receipt template for receipting is a good idea to ensure that you never miss important details. It also helps keep the donor experience better. Also, make sure that the receipt includes a thank-you message is important to keep the message simple and uplifting.

- Name of the organization to which the donation has been made;

- A confirmation of the registration of the organization

- Name of the Donor

- Date of donation received

- Type of donation (cash, kind, goods)

- Amount of donation

- A statement that clearly states that the organization did not provide goods or services in return for the donation.

- Name and Signature of the donor and the organization that received the donation

Best Practices While Writing Charity Receipt Template

The words receipts, donors, and non-profits sound very conventional and easy to understand. But when it comes to implementing a document that can be helpful for legal activities, it needs special attention. So, here are some of the tips and tricks that can help you draft a simple yet effective donation receipt for your organization.

1. Make it clean

It is important to have a receipt with very easy and simple data, and the cleaner the receipt will look, the more clarity people will have. A simple receipt will depict clear messages with absolutely no hidden activities. You can also keep a donation receipt template ready, which can be helpful and easy to manage.

2. Give the donor a basic idea

Donors should know how much of the donation is tax-deductible. If you’re giving away a gift or service in exchange for a donation, the value of this will need to be added to the total amount donated to your organization.

3. Provide all your details to the donor before making the donation

Think about including some background details about your organization and your mission. This can be important for the donor and can help them feel included, and it may encourage repeat donations.

4. Donation management software

A good donor database is an essential part of any organization. With the help of donation management software, you can easily organize and maintain all of the information about donors and their donations. As much data tends to get lost during communication, donor management software can be the single point of the database to refer to.

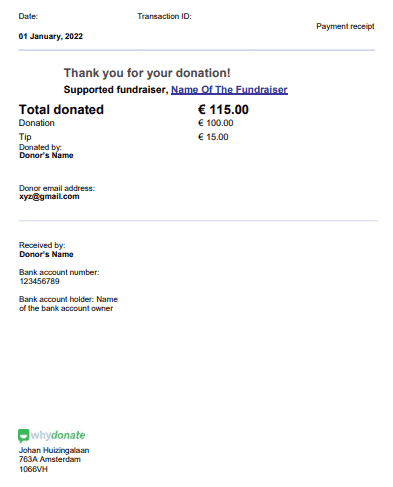

Charity Donation Receipt Example

We at WhyDonate always adhere to the best policies when it comes to donation receipts. WhyDonate’s donation platform generates receipts automatically, sends them to the donors and shows them in the fundraiser organizer’s dashboard, making it completely hassle-free. Feel free to use this as a charitable donation receipt template:

Getting the proper documentation for your charitable organization is very important. Make sure that you’re aware of the requirements for your country when it comes to sending out donation receipts. Having the necessary information will help your donors feel valued and safe. Now, you are all set and ready to draft your donation receipt with our non profit donation receipt template.

WhyDonate is one of the most versatile global crowdfunding platforms, and it does everything by the books. It is one of the best fundraising platforms for nonprofits that are affordable and equipped with many features like global fundraising, task automation, donation plugins and donation receipts, all within one roof so that you don’t have to worry about anything other than your fundraising goals. Start your fundraiser right away!

FAQ (Frequently Asked Questions)

How to make a receipt for donation?

To create a donation receipt, include the non-profit’s name, address, and contact details. Add the donor’s information, donation amount, date, and payment method. Specify the donation purpose and include a statement confirming tax-exempt status. Finally, include an authorized signature and a note of appreciation.

How to give a receipt for charitable donation?

Provide the receipt via email, print, or online donor portals. Ensure it includes essential details like the donor’s name, donation amount, and tax-deductible confirmation. For recurring donations, issue receipts monthly or annually. Always express gratitude to maintain donor relationships and comply with tax regulations.